CREDITO: You’re Credit on the Decentralized Network

Introduction

What's your worth in the market is determined by your credit history? Your financial transactions decide your next loan sanction. The credit score is the top financial indicator for companies to decide whether the applicant is loan-worthy or not. It might not be visible to the young population but it is definitely most important checkpoint for banks and financial institutions. The biggest problem with the credit score companies is that they are controlled by a handful of companies. This monopoly leads to power abuse, and lack of diversity.

The recent hack at Equifax, where more than 100 million accounts were affected is a grim example of the kind of system we are trusting. The rise in e-commerce has raised digital transactions, which have fueled the rise of online data theft and credit card hacks. According to a report by Nilson, the losses from credit card fraud is estimated to be 31 billion dollars by 2020.

We cannot be living in more serious circumstances than today, where we are always at potential risk of identity theft or loss of personal information. Another reason that leads to such complex scenario is a usage of the centralised system. This leads to inefficient decision making, slow process, the rise in the number of intermediaries and opaque system. We need a transparent system that is efficient, secure, decentralised and easy to use for lenders and borrowers.

SOLUTION OFFERED

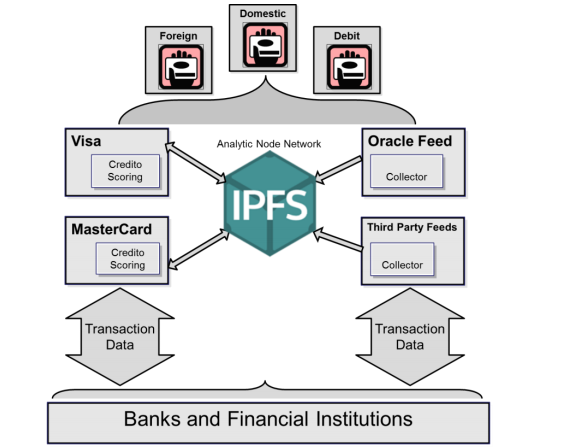

We cannot be more right than this when we choose to see the solution presented by CREDITO. It is a decentralised network powered by blockchain capability. The credit Intelligence and decentralised lending marketplace are two of its core features, which will help the lenders and borrower to be involved in business without any external agent.

The ethereum blockchain network will help bring security and decentralisation to this platform, which aims to bring more transparent and inclusive credit management system. The platform is unique in many ways, and a few of the top distinct features of the platform are mentioned below.

- interplanetary File System(IPFS) to store encrypted data to be used in the CREDITO platform

- CREDITO Scores based on CREDITO analytics engine, which is based on self-learning algorithm

- Loan agreements between the engaging parties are trust- less and based on smart contracts

- Analytics services coupled with CREDITO transaction scores

- Profile matching services for borrowers and lenders based on vast transactional data

- CreDApp for lenders and borrowers which also acts as a decentralised marketplace.

This platform brings a comprehensive solution to the lending market by removing third-party intervention. We can only be helping ourselves if we get to use this platform because it has the capability of redefining the whole credit market.

The continuous development of the Technology has pushed the cybercriminals to the extreme, and this acts as a true saviour of our personal information and credit history.

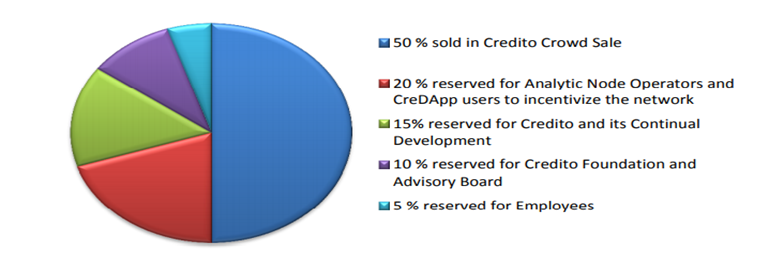

To grow this platform on a global scale and develop it further, they will be conducting an ICO. 50% of Token will be available to the public while 20% will be reserved for the analytic node operators.

45% of funds will be utilised for the research & development while 20% will be utilised for network infrastructure. They are going to build a super-efficient and secure platform based on blockchain technology.

45% of funds will be utilised for the research & development while 20% will be utilised for network infrastructure. They are going to build a super-efficient and secure platform based on blockchain technology.

The Team at CREDITO is experienced in the fields of banking and technology. Srikar has more than a decade of experience in data communications and finance. They are able and credible professionals ready to deliver change.

CONCLUSION

What we might miss today is the need of a platform, which is not only secure but also future proof and CREDITO delivers in both the aspects. There is increased data theft in the recent decade, which only goes on to prove that time has come for the Major system overhaul. I think we can be more encouraging of the ideas and concepts, which are aligned with our security and personal data management. There cannot be two-way about it.

I have seen multiple platforms offering great financial tools and products, but what they really lack or lose focus on is the safety of Customer's personal information, which should be the topmost priority for any company.

Published By: Syaeief28

Btalk profile: https://bitcointalk.org/index.php?action=profile;u=2197847

Eth: 0xFa81c87127F42fA562770c6c8F71b6EaE995D578

Tidak ada komentar:

Posting Komentar